Many traders believe that success in forex trading comes from finding the perfect entry. Indicators, chart patterns, and technical signals often receive the most attention. However, year after year, data shows that most retail traders continue to struggle with long-term profitability.

The real problem is rarely the strategy itself. In most cases, the missing factor is forex risk management.

By 2026, forex market conditions have changed significantly. Volatility cycles are sharper, liquidity can shift within seconds, and execution costs play a much larger role in overall performance. Relying solely on stop losses or fixed risk rules is no longer enough to protect trading capital.

Modern traders need a structured risk framework that accounts for position sizing, drawdown control, execution quality, and real-world trading conditions. Professional traders focus on managing exposure before worrying about entries.

This guide explains how forex risk management works in today’s markets, why traditional methods often fail, and how experienced traders control risk to achieve consistent, sustainable results.

What Is Forex? A Quick Context Before Risk Management

Before discussing risk, it’s important to understand what is forex and why risk plays such a central role in trading outcomes. The foreign exchange (forex) market is the largest financial market in the world, with trillions of dollars traded every day across global currencies.

In forex trading, currencies are traded in pairs, and price movements are often relatively small. To make these movements meaningful, traders commonly use leverage. While leverage can amplify profits, it also magnifies losses just as quickly.

Even a small move against a leveraged position can result in a significant drawdown if risk is not managed correctly. This is why forex risk management is not optional; it is foundational to survival in the market. Without a structured approach to managing exposure, leverage turns from a tool into a threat, regardless of how strong a trading strategy may appear.

What Is Forex Risk Management in Modern Trading?

Forex risk management refers to the structured process of identifying, measuring, and controlling potential losses in currency trading. It is not about avoiding losses entirely losses are a normal part of trading. Instead, effective risk management ensures that losses remain limited, controlled, and recoverable over time.

At its core, risk management answers three critical questions:

How much capital can be risked on a single trade?

How much total exposure is currently active in the market?

What happens to the account if several trades fail in a row?

Many beginner traders assume risk management simply means placing a stop loss. In reality, stop losses are only one component of a much broader framework. Modern risk management also includes position sizing, drawdown control, exposure limits, and execution quality.

In today’s fast-moving markets, successful traders treat risk management as a system, not a rule one that protects capital first and performance second.

How Risk Management in Forex Trading Has Changed in 2026

Risk management in forex trading has evolved significantly over the last few years.

Several factors have reshaped the landscape:

- Faster news transmission and algorithmic reactions

- Increased retail participation during volatile sessions

- Liquidity gaps during off-hours

- Wider spreads during high-impact events

In 2026, traders must consider execution quality, correlation risk, and portfolio exposure not just individual trades. Ignoring these elements leads to unexpected losses even when strategies appear sound on paper.

This evolution has made forex risk management more data-driven and less emotional.

Why Stop Losses Alone Are No Longer Enough

Stop losses remain an essential part of trading, but in modern markets, they are no longer a complete risk solution. Relying on stop losses alone creates a false sense of protection that often breaks down during real market conditions.

Slippage is one major issue. During volatile sessions or news releases, trades can be filled far worse than the intended stop price. Market gaps present another risk, as price can skip stop levels entirely, resulting in larger-than-expected losses. Correlated trades also amplify exposure, meaning multiple positions can be stopped out simultaneously even when each trade appears individually controlled.

Emotional behavior further weakens stop-loss effectiveness. Traders frequently widen or remove stops under pressure, distorting both discipline and results.

Professional traders view stop losses as damage control, not risk control. Effective forex risk management begins before a trade is placed through position sizing, exposure planning, and scenario analysis long before a stop is ever triggered..

Trade Risk Assessment: Measuring Risk Before You Enter

Trade risk assessment is the process of evaluating risk before execution.

This includes:

- Risk-to-reward ratio

- Market volatility at entry

- Time exposure (intraday vs swing)

- Event risk (news, economic releases)

Instead of asking “How much can I make?”, professional traders ask “How much am I risking if this fails?”

This mindset shift is one of the biggest differences between losing traders and consistently profitable ones.

Position Sizing Strategies That Actually Protect Capital

Among all aspects of forex risk management, position sizing is one of the most misunderstood.

Position sizing strategies determine how large each trade should be relative to your account size. Even a strong strategy will fail if position sizing is incorrect.

Common professional approaches include:

- Fixed percentage risk per trade

- Volatility-adjusted position sizing

- Equity-based scaling

- Risk normalization across instruments

Many traders rely blindly on calculators, but calculators only work when combined with proper risk logic. Without that logic, numbers provide false confidence.

Drawdown Control: The Metric That Determines Survival

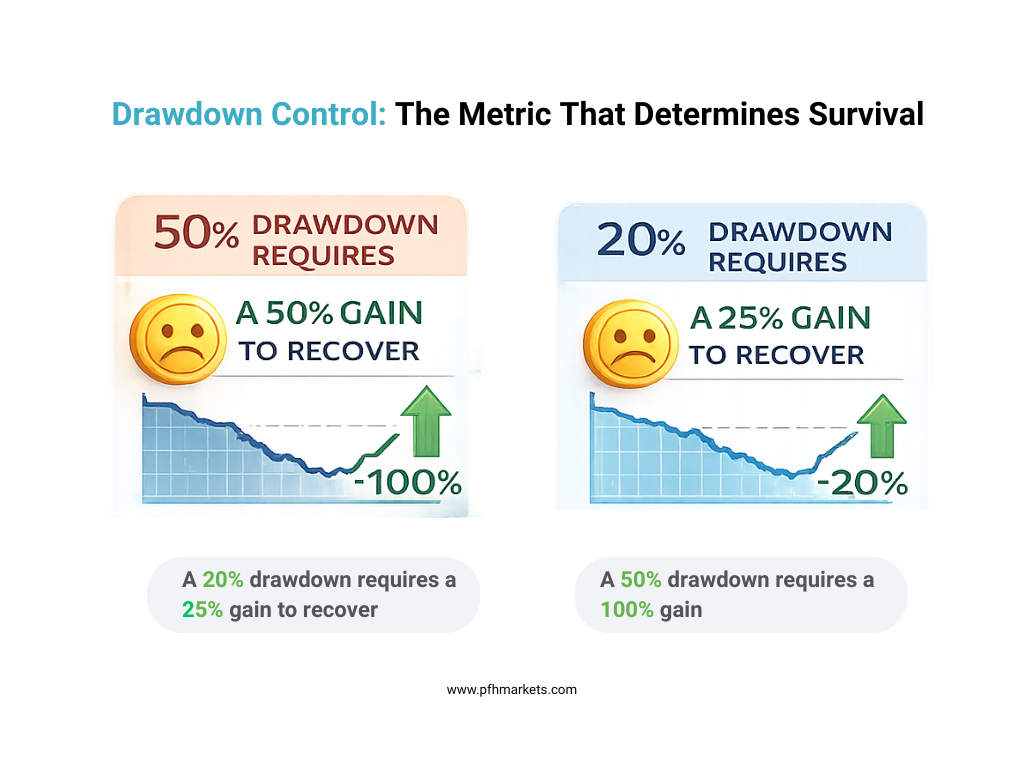

A drawdown refers to the decline in an account’s equity from its highest point to its lowest point during a period of trading. As drawdowns increase, the difficulty of recovering losses grows significantly. For example, a 20% drawdown requires a 25% gain just to break even, while a 50% drawdown demands a 100% gain to recover the original capital. Because of this compounding effect, institutions enforce strict drawdown limits, fully aware of both the mathematical disadvantage and the psychological strain caused by deep losses. Retail traders who ignore drawdown control often leave the market not due to poor strategies, but because sustained

Using a Forex Risk Management Calculator (And Its Limits)

A forex risk management calculator is a useful tool for estimating position size based on account balance, risk percentage, and stop-loss distance. It helps traders apply consistent risk rules and avoid overexposure on individual trades. However, calculators are only as reliable as the assumptions behind them.

They typically do not account for:

- Slippage during volatile markets

- Swap costs on overnight positions

- Correlation between multiple trades

- Variable spreads

Because of these limitations, calculators should be used as support tools not decision-makers. Effective forex risk management still requires situational awareness, market judgment, and an understanding of execution conditions. Automation can assist discipline, but it cannot replace thoughtful risk planning in live trading environments.

Common Risk Management in Forex Trading Mistakes Still Made in 2026

Despite improved education and access to information, many traders in 2026 continue to repeat the same forex risk management mistakes. Increasing risk after losses often leads to emotional decision-making, while overleveraging during low-volatility periods creates unnecessary exposure. Ignoring overnight swap costs can quietly reduce profitability, especially for swing and position traders, and trading multiple correlated pairs can unintentionally multiply risk. These mistakes rarely cause immediate account blow-ups, but they steadily erode capital over time, which is why many traders struggle or exit the market without clearly understanding what went wrong.

How Professional Traders Approach Forex Risk Management

Professional and institutional traders view forex risk management at the portfolio level.

They focus on:

- Total exposure across markets

- Correlation matrices

- Maximum daily loss limits

- Weekly and monthly risk caps

Rather than asking, “Is this trade good?” professionals ask, “Does this trade fit within my overall risk framework?” This top-down approach allows institutions to remain resilient, adapt to changing conditions, and survive long periods of uncertainty in global currency markets

The Role of Broker Choice in Risk Management

Execution quality is a critical but often overlooked component of modern forex risk management. Even with precise position sizing and strict risk limits, poor execution can significantly distort real trading results. Factors such as spread stability, execution speed, and available liquidity directly influence how closely live trades match planned outcomes.

Choosing a reliable Forex and CFD Broker is therefore essential. Wide or inconsistent spreads, frequent slippage, and delayed order execution can turn a properly managed trade into an unexpected loss. Professional traders prioritize brokers that provide transparent pricing, consistent liquidity, and dependable execution during volatile conditions. Working with a stable Forex and CFD Broker supports disciplined risk control and helps ensure that strategy performance reflects actual market behaviour rather than execution inefficiencies.

Why Your Forex Trading Platform Matters More Than You Think

Your Forex Trading Platform influences trading risk in subtle but important ways. A reliable platform delivers accurate pricing, stable order execution, clear margin visibility, and fast order modification, all of which are essential for controlling risk in real time. When platforms suffer from delays, freezes, or price mismatches, even well-planned trades can turn into unexpected losses.

Using a trusted Forex Trading Platform helps ensure that risk rules are applied consistently, allowing traders to execute strategies as intended in live market conditions.

Building a Sustainable Forex Risk Management Plan for 2026

Building a sustainable forex risk management plan for 2026 requires structure, discipline, and consistency. A strong plan defines a fixed risk percentage per trade, sets clear maximum daily and weekly loss limits, and applies consistent position sizing rules to control exposure. It also includes drawdown thresholds to protect capital during losing periods and regular performance reviews to identify strengths and weaknesses over time. Rather than relying on complex systems, traders benefit more from a simple, well-defined plan that is followed consistently.

In the long run, disciplined execution of basic rules will always outperform a complicated strategy applied emotionally.

Final Thoughts: Risk Management Is the Real Strategy

In 2026, successful trading is less about prediction and more about protection.

Strategies come and go. Market conditions change. Indicators stop working. But forex risk management remains the constant that determines whether traders survive long enough to benefit from opportunity.

Stop losses are only the beginning. True edge comes from understanding exposure, controlling drawdowns, sizing positions intelligently, and respecting execution realities.

In the end, trading success is not about how much you can make on your best trade, it’s about how little you lose on your worst ones.

FAQ

Is using a stop loss enough for proper forex risk management?

No. Stop losses are only one part of a complete risk system. Modern forex risk management also includes position sizing, exposure control, drawdown limits, and correlation analysis. Relying solely on stop losses can lead to unexpected losses due to slippage, gaps, or volatile execution.

How do professional traders manage risk differently from retail traders?

Professional traders manage risk at the portfolio level. Instead of focusing on individual trades, they monitor total exposure, correlation between positions, maximum daily losses, and overall drawdown control. This structured approach allows them to remain profitable even during unpredictable market phases.

What role does position sizing play in forex risk management?

Position sizing determines how much capital is exposed on each trade. Proper position sizing strategies ensure that no single trade can cause significant account damage. It is one of the most effective tools for long-term capital preservation and consistent performance in forex trading.

Are forex risk management calculators reliable?

Forex risk management calculators are useful for estimating lot size and risk per trade, but they have limitations. Most calculators do not account for slippage, variable spreads, swap fees, or trade correlation. They should support decision-making, not replace disciplined risk planning.