The cryptocurrency market moves in predictable patterns known as crypto market cycles, recurring phases of growth, decline, and stabilization that separate successful traders from those who buy high and sell low. Understanding these cycles isn’t just about identifying trends; it’s about positioning yourself strategically before the market makes its next major move.

Smart traders know that the real profits aren’t made during the frenzy of a bull market; they’re set up during the quiet accumulation phases that most investors ignore. Whether you’re tracking the bitcoin cycle, waiting for the next altcoin season, or learning when to practice crypto accumulation, mastering market cycles is your blueprint for consistent returns in an unpredictable market.

In this guide, we’ll break down the four distinct phases of crypto market cycles, reveal how experienced traders prepare for bull runs, and show you the exact indicators to watch so you’re never caught off guard again.

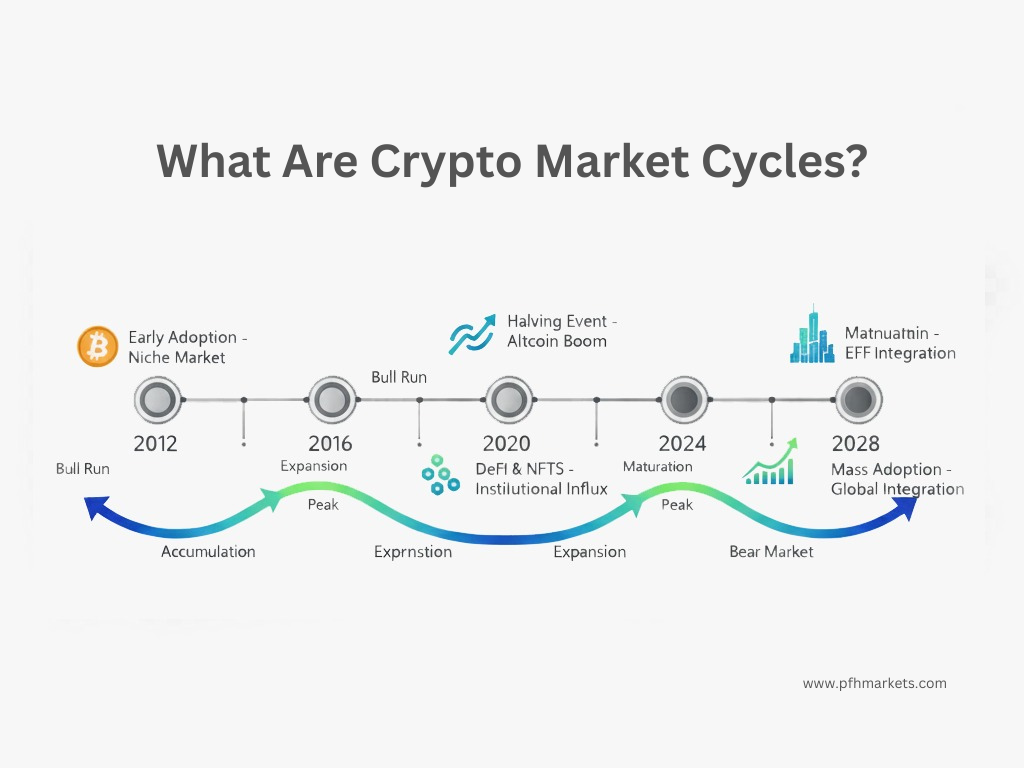

What Are Crypto Market Cycles?

Crypto market cycles are recurring patterns of price movements that characterize the cryptocurrency market, moving through distinct phases of growth (bull market) and decline (bear market). Unlike traditional financial markets that may take decades to complete full cycles, crypto operates on an accelerated timeline, with complete cycles often occurring every 3-4 years.

These cycles exist because cryptocurrency markets are driven by:

Bitcoin Halving Events:

Approximately every four years, Bitcoin’s mining rewards are cut in half, reducing new supply and historically triggering major price appreciation. This bitcoin cycle rhythm tends to influence the entire crypto market.

Investor Psychology:

The crypto market is particularly susceptible to emotional trading fear and greed drive dramatic swings as retail and institutional investors react to price movements, news, and market sentiment.

Macroeconomic Factors

Interest rates, inflation concerns, regulatory developments, and global economic conditions all impact investor appetite for risk assets like cryptocurrencies.

Liquidity Flows

As capital rotates through the market from Bitcoin to large-cap altcoins to smaller projects it creates predictable patterns of outperformance across different asset classes.

Understanding crypto market cycles explained gives you a framework to recognize where we are in the current cycle and what’s likely to happen next, allowing you to make informed decisions rather than emotional reactions.

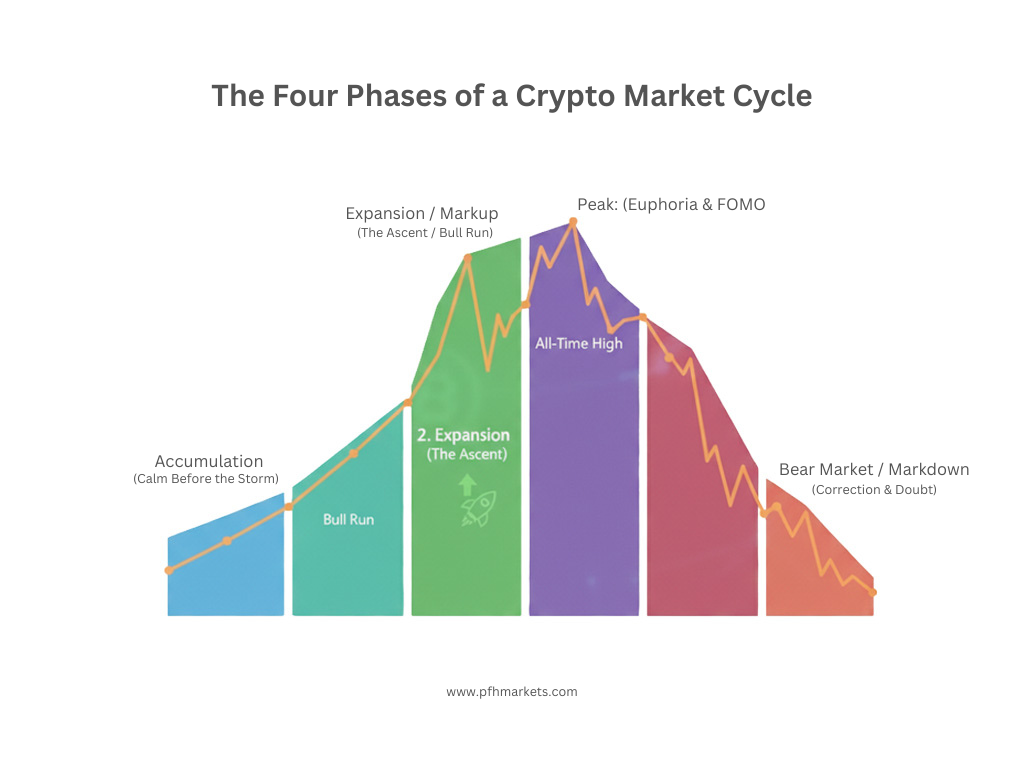

The Four Phases of a Crypto Market Cycle

Every crypto market cycle progresses through four distinct phases. Recognizing which phase the market is in helps you adapt your strategy accordingly.

Accumulation Phase

The accumulation phase occurs after a prolonged bear market when prices have bottomed out and stabilized at low levels. This is when “smart money” experienced investors and institutions—begins quietly accumulating positions while the general public remains pessimistic or disinterested.

Key characteristics of crypto accumulation:

- Prices trade sideways in a relatively tight range after significant declines

- Trading volume is typically low, indicating lack of public interest

- Negative sentiment dominates media coverage and social discussions

- Long-term holders and whales accumulate positions at discounted prices

- Weak hands have already sold, leaving only committed believers

How to spot this phase:

Look for decreasing volatility after a major decline, declining exchange balances (indicating accumulation off exchanges), and divergence between price action and on-chain metrics showing increased wallet activity. Bitcoin typically leads this phase, with altcoins remaining depressed.

Example: Following the 2022 bear market, Bitcoin spent much of 2023 in a consolidation range between $25,000-$31,000, allowing smart traders to accumulate before the 2024 rally.

Bull Market (Markup Phase)

The bull market phase is characterized by sustained price increases as optimism returns to the market. This is when the broader public begins to take notice, FOMO (fear of missing out) kicks in, and new investors flood into the space.

Key characteristics:

- Consistent higher highs and higher lows in price action

- Rapidly increasing trading volume and market participation

- Mainstream media coverage turns positive

- New projects launch and gain traction quickly

- The bitcoin cycle typically leads, with altcoins following with amplified gains

How traders identify entry points:

Smart traders enter during the early bull market when prices break above major resistance levels with strong volume confirmation. They look for breakouts from accumulation ranges, golden crosses (50-day MA crossing above 200-day MA), and shifts from negative to neutral sentiment.

The key is entering before the masses arrive when optimism is growing but euphoria hasn’t yet taken hold. Late-stage bull market entries are risky, as prices become disconnected from fundamentals.

Distribution Phase

At market peaks, the distribution phase begins when early investors and smart money start taking profits while retail investors are still buying aggressively. Prices may continue rising initially, but momentum slows and volatility increases.

Key characteristics:

- Price makes several attempts at new highs but struggles to break through

- Increased volatility with sharp intraday swings

- Divergences appear (price makes new highs while indicators don’t)

- Insider selling and whale wallets moving coins to exchanges

- This often marks the beginning of altcoin season, as Bitcoin dominance falls and capital rotates into alternative cryptocurrencies

Recognizing altcoin season:

Altcoin season typically occurs during the late bull market and distribution phase when Bitcoin has rallied significantly and investors seek higher returns in smaller-cap projects. The Altcoin Season Index can help confirm when 75% or more of top altcoins are outperforming Bitcoin.

Bear Market (Markdown Phase)

The bear market is the painful but necessary phase where prices decline sharply, often giving back 70-90% of bull market gains. Fear replaces greed, and many new investors capitulate and leave the market entirely.

Key characteristics:

- Sustained downtrend with lower highs and lower lows

- Dramatic reduction in trading volume and public interest

- Negative news dominates; bankruptcies and failures emerge

- Projects fail, and many altcoins never recover

- Long consolidation periods at depressed price levels

Survival strategies:

Experienced traders protect capital during bear markets through position sizing (reducing exposure significantly), focusing only on the highest-quality assets (Bitcoin and major altcoins), dollar-cost averaging at lower levels, and maintaining cash reserves to deploy during the accumulation phase. For a comprehensive guide on protecting your trading capital across all market conditions, see our article on trading risk management explained: how professionals protect capital.

Historical context:

Bear markets in crypto typically last 12-18 months. The 2018 bear market saw Bitcoin fall from $20,000 to $3,200. The 2022 bear market dropped from $69,000 to $15,500. Understanding that these phases are temporary, not permanent, is crucial for long-term success.

How to Prepare for the Next Bull Run

Smart traders don’t wait for the bull market to arrive; they prepare during the bear market and accumulation phases. Here’s your action plan:

Monitor Bitcoin Cycle Trends

The bitcoin cycle, driven largely by halving events, provides a roadmap for the broader market. Bitcoin halvings have occurred in 2012, 2016, 2020, and most recently in April 2024. Historically, major bull runs have followed 12-18 months after each halving as reduced supply meets increasing demand.

Track the halving countdown and position yourself during the 6-12 months following the event when prices are still consolidating before the parabolic move.

Identify Crypto Accumulation Opportunities

The best time to build positions is when no one is talking about crypto. During accumulation phases:

- Set price alerts for key support levels where you want to buy

- Use dollar-cost averaging to build positions gradually

- Focus on assets with strong fundamentals and active development

- Monitor whale wallet accumulation patterns for confirmation

- Accumulate during periods of maximum pessimism

Evaluate Altcoin Season Potential

Not all altcoins survive full market cycles. Before altcoin season arrives, research projects with:

- Strong development teams and active GitHub commits

- Real-world use cases and adoption metrics

- Healthy tokenomics with controlled supply inflation

- Active communities and partnership announcements

- Performance history through previous market cycles

Create a watchlist before altcoin season begins so you’re ready to deploy capital when rotation occurs.

Implement Risk Management During Bear Markets

Preservation of capital is crucial:

- Never invest more than you can afford to lose completely

- Use position sizing (no more than 5-10% in any single asset)

- Set stop-losses to protect against catastrophic declines

- Maintain 30-50% cash reserves for opportunities

- Avoid leverage and high-risk derivatives during uncertain periods

Utilize Market Timing Tools

Several tools help identify cycle positioning:

- Bitcoin Rainbow Chart: Color-coded price zones indicating whether Bitcoin is cheap, fair value, or overpriced

- Fear and Greed Index: Measures market sentiment from extreme fear (buying opportunity) to extreme greed (distribution warning)

- Moving average crossovers: 50/200 day MA signals for trend changes

- On-chain metrics: Exchange balances, accumulation addresses, and realized price indicators

Common Mistakes Traders Make During Market Cycles

Even experienced investors fall victim to these cycle-related errors:

Overtrading in a Bull Market

The excitement of rising prices tempts traders to overtrade, chasing every pump and constantly rotating positions. This strategy typically underperforms simply holding quality assets through the bull run. Transaction fees, taxes, and poor timing erode gains. Even worse, many traders compound this mistake by overleveraging their positions learn why overleveraging is the #1 reason traders blow accounts.

Instead, identify 5-10 high-conviction positions during accumulation, then hold through the majority of the bull market. Take profits in stages during distribution, but avoid excessive trading.

Panic Selling During Bear Markets

The most costly mistake is selling near the bottom after holding through the entire decline. Fear peaks at market lows, causing capitulation precisely when smart money is accumulating.

Combat this by setting predetermined price targets for selling during bull markets, never investing money you need short-term, and maintaining conviction in quality projects through downturns.

Ignoring Macro Events and Bitcoin Halving

Many traders focus only on price charts while ignoring the fundamental drivers behind crypto market cycles. Bitcoin halving events have preceded every major bull run, yet traders are often surprised when they occur.

Mark halving dates on your calendar (next expected in 2028) and understand how macroeconomic conditions interest rates, inflation, regulatory clarity impact risk asset appetite including cryptocurrencies.

Failure to Take Profits

Perhaps the most common regret is riding positions from accumulation through the entire bull market and back down again without taking any profits. The “hold forever” mentality sounds good in theory but ignores the cyclical nature of crypto.

Develop a profit-taking strategy: sell 20-30% at predetermined price targets during the markup phase, another 30-40% during distribution, and hold the remainder through the bear market for the next cycle.

Key Indicators to Track Crypto Market Cycles

Successful cycle navigation requires monitoring both technical indicators and fundamental metrics:

Technical Indicators

- Moving Averages: The 200-day MA serves as major support/resistance. Price consistently above this level indicates bull market conditions; below suggests bear market. Golden crosses (50-day MA above 200-day) and death crosses (opposite) signal trend changes.

- RSI (Relative Strength Index): Values above 70 indicate overbought conditions common during late bull markets; below 30 suggests oversold conditions typical of bear markets and accumulation phases.

- MACD (Moving Average Convergence Divergence): Crossovers of the MACD line above the signal line suggest bullish momentum; crossovers below indicate bearish conditions. Divergences between price and MACD warn of potential reversals.

Sentiment Analysis Tools

- Crypto Fear & Greed Index: Aggregates volatility, volume, social media sentiment, and surveys into a single 0-100 score. Extreme fear (0-25) historically marks buying opportunities; extreme greed (75-100) warns of tops.

- Social Media Metrics: Track Twitter mentions, Reddit activity, and Google Trends for crypto-related searches. Declining interest during bear markets signals accumulation opportunities; viral growth indicates late-stage bull markets.

On-Chain Data Metrics

- Exchange Balances: Decreasing Bitcoin balances on exchanges indicates accumulation (investors moving coins to cold storage). Increasing balances suggests preparation for selling.

- Whale Activity: Large wallet movements (100+ BTC) can signal upcoming volatility. Accumulation by whales during low prices confirms the accumulation phase.

- NUPL (Net Unrealized Profit/Loss): This metric shows whether holders are in aggregate profit or loss. Values near zero occur during accumulation; extremely high values indicate distribution phases.

- MVRV Ratio: Market value to realized value ratio helps identify overvalued (MVRV > 3.5) and undervalued (MVRV < 1) conditions.

Combine multiple indicators rather than relying on any single metric. Confluence across technical, sentiment, and on-chain data provides the strongest signals for cycle positioning.

Conclusion

Understanding crypto market cycles explained is the difference between randomly reacting to price movements and strategically positioning yourself for maximum gains. The pattern is clear: accumulation phases reward patience, bull markets reward preparation, distribution phases demand discipline, and bear markets test conviction.

Smart traders don’t try to time every peak and valley perfectly; they recognize whi

ch phase the market is in and adjust their strategy accordingly. By monitoring the bitcoin cycle, identifying quality crypto accumulation opportunities during bear markets, and preparing for altcoin season rotation during bull runs, you can consistently outperform investors who trade on emotion rather than cycle awareness.

The next bull market is always on the horizon, being set up during the quiet accumulation phases that most people ignore. The question isn’t whether another bull run will come it’s whether you’ll be prepared when it arrives. For detailed execution tactics to complement your cycle knowledge, explore our guide on cryptocurrency trading strategies: mastering the crypto market.

Ready to apply these crypto market cycle insights to your trading strategy? Explore PFH Markets‘ comprehensive tools and guides designed specifically for cryptocurrency traders who want to move beyond guessing and start positioning themselves strategically for every phase of the market cycle. Our platform provides real-time indicators, educational resources, and risk management tools to help you navigate the complete cycle with confidence.

Start preparing for the next bull run today because by the time everyone else is talking about crypto again, the best opportunities will already be behind you.

FAQ

What is the difference between a bull market and altcoin season?

A bull market refers to the overall upward trending phase across the entire cryptocurrency market, typically led by Bitcoin. Altcoin season is a specific period within the bull market (usually during late stages) when alternative cryptocurrencies significantly outperform Bitcoin. During altcoin season, investors rotate profits from Bitcoin into higher-risk, higher-reward altcoins seeking amplified gains.

How can I spot the accumulation phase?

The accumulation phase is characterized by: prices trading sideways after significant declines, low volatility and trading volume, overwhelmingly negative sentiment, coins moving from exchanges to private wallets (indicating long-term holding), and technical indicators showing oversold conditions for extended periods. Look for stabilization after panic selling has exhausted itself.

Does Bitcoin dictate all crypto market cycles?

Yes, Bitcoin remains the dominant force driving crypto market cycles due to its 40%+ market dominance, first-mover advantage, and position as the gateway for most institutional capital entering crypto. The bitcoin cycle, particularly driven by halving events, sets the rhythm for the broader market. While altcoins may have independent movements short-term, they generally follow Bitcoin's macro directional trends.

How should beginners trade during bear markets?

Beginners should focus on capital preservation and education during bear markets rather than aggressive trading. Key strategies include: reducing position sizes significantly (hold mostly cash), dollar-cost averaging into only the highest-quality projects (Bitcoin, Ethereum, and top-tier altcoins), avoiding leverage entirely, using the time to learn technical analysis and fundamental research, and preparing watchlists for the next accumulation phase. Most importantly, never try to catch falling knives, wait for clear bottoming patterns before deploying significant capital.